Indicators on Hard Money Georgia You Should Know

Wiki Article

Everything about Hard Money Georgia

Table of ContentsSome Known Details About Hard Money Georgia Hard Money Georgia Things To Know Before You BuyTop Guidelines Of Hard Money GeorgiaThe Ultimate Guide To Hard Money GeorgiaSome Of Hard Money Georgia

A certain resources barrier is still required. Difficult cash loans, occasionally referred to as bridge financings, are short-term borrowing instruments that investor can utilize to finance an investment task. This kind of funding is frequently a device for house flippers or property developers whose goal is to refurbish or establish a home, after that sell it for a revenue. There are two main downsides to take into consideration: Hard money finances are hassle-free, but financiers pay a cost for obtaining by doing this. The rate can be up to 10 portion factors more than for a standard financing. Source costs, loan-servicing costs, and also shutting prices are also likely to cost investors a lot more (hard money georgia).

As an outcome, these finances feature much shorter settlement terms than standard mortgage loans. When picking a hard cash loan provider, it's essential to have a clear idea of just how soon the property will come to be rewarding to guarantee that you'll be able to settle the finance in a timely way.

Hard Money Georgia Fundamentals Explained

Once more, lenders might permit capitalists a little bit of freedom right here.Difficult money fundings are a great fit for rich investors that require to obtain funding for an investment residential or commercial property quickly, without any of the red tape that goes along with bank financing. When evaluating tough cash lending institutions, pay attention to the charges, rate of interest, as well as car loan terms. If you end up paying excessive for a difficult money loan or reduce the payment period also short, that can influence how successful your realty venture is in the long term.

If you're seeking to buy a home to flip or as a rental residential or commercial property, it can be testing to obtain a conventional mortgage. If your credit rating isn't where a standard loan provider would certainly like it or you need cash extra swiftly than a lender has the ability to offer it, you can be unfortunate.

Our Hard Money Georgia Statements

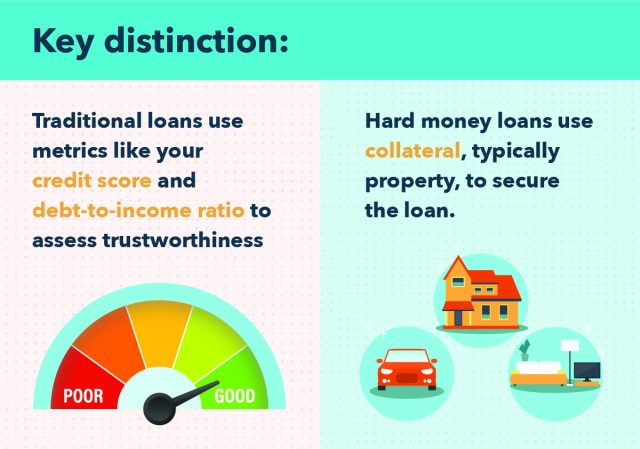

Hard cash financings are temporary secured fundings that utilize the building you're purchasing as collateral. You will not find one from your bank: Difficult money financings are offered by alternate loan providers such as individual capitalists and also exclusive companies, who commonly ignore sub-par credit history as well as other monetary elements as more helpful hints well as instead base their choice on the residential property to be collateralized (hard money georgia).

Difficult money fundings provide numerous advantages for customers. These include: From beginning to finish, a tough money finance may take simply a few days.

It's key to consider all the dangers they reveal. While difficult money car loans included benefits, a consumer should additionally consider the dangers. Amongst them are: Hard cash lending institutions typically charge a higher rates of interest since they're presuming even more risk than a go now standard lending institution would. Once again, that's due to the risk that a difficult cash lending institution is taking.

Getting The Hard Money Georgia To Work

You're unsure whether you can pay for to repay the hard money lending in a short time period. You've obtained a strong credit rating Website as well as need to be able to certify for a typical finance that most likely carries a reduced rates of interest. Alternatives to tough money finances consist of conventional mortgages, residence equity lendings, friends-and-family loans or funding from the residential property's seller.

Getting My Hard Money Georgia To Work

It is essential to take into consideration factors such as the loan provider's online reputation and also rates of interest. You may ask a trusted property agent or a fellow house flipper for referrals. As soon as you've pin down the appropriate hard cash loan provider, be prepared to: Create the deposit, which commonly is heftier than the deposit for a conventional home mortgage Collect the necessary documentation, such as proof of earnings Potentially hire an attorney to review the regards to the funding after you've been accepted Map out an approach for paying off the finance Equally as with any type of financing, assess the pros and disadvantages of a difficult money funding before you dedicate to borrowing.Regardless of what type of car loan you choose, it's possibly a good idea to check your cost-free credit rating and free credit rating record with Experian to see where your financial resources stand.

(or "exclusive money funding") what's the very first point that goes through your mind? In previous years, some poor apples stained the hard money lending industry when a few predative lenders were trying to "loan-to-own", offering very dangerous loans to borrowers utilizing actual estate as security as well as intending to seize on the homes.

Report this wiki page